To help reduce the effects of inflation, the U.S. Government has passed the Inflation Reduction Act of 2022. The act includes federal tax credits for the installation of qualifying high-efficiency, ENERGY STAR® certified heating and cooling products.

Tax Section 25C, Nonbusiness Energy Property Credit

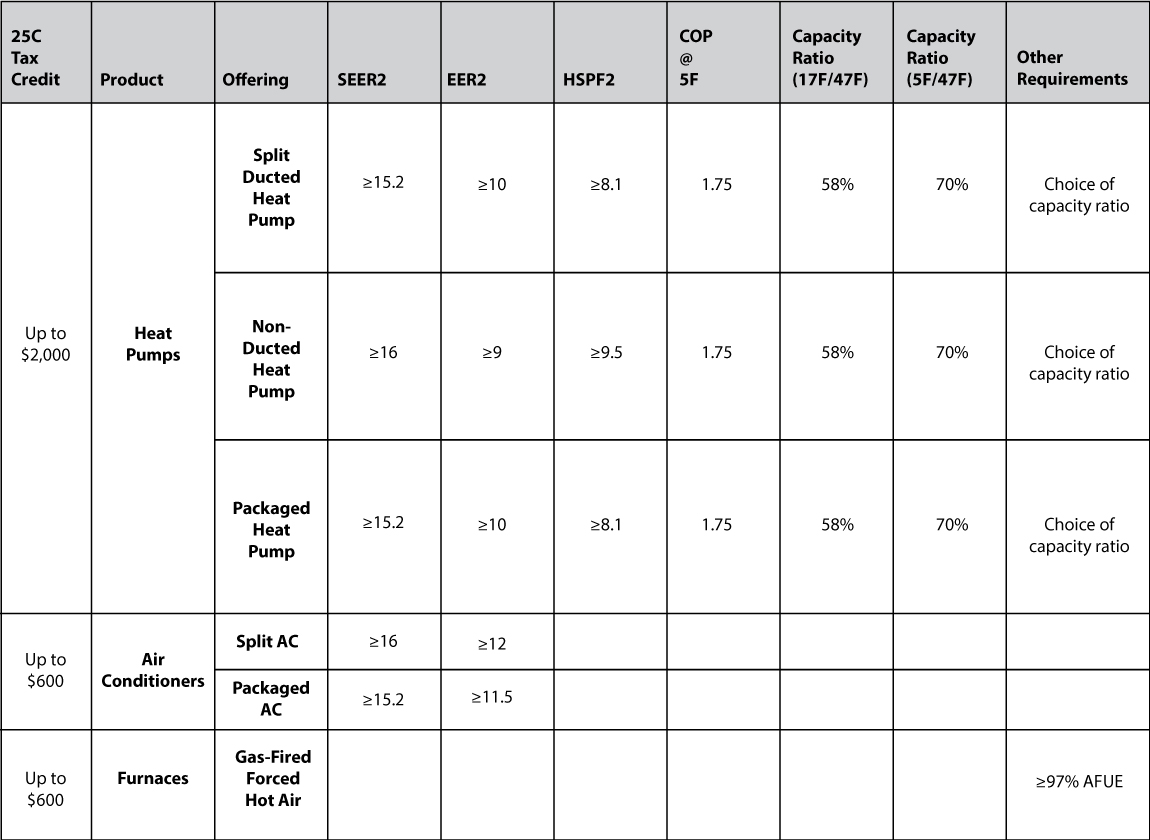

Effective Jan 1, 2023: Provides a tax credit to homeowners equal to 30% of installation costs for the highest efficiency tier products, up to a maximum of $600 for qualified air conditioners and furnaces, and a maximum of $2,000 for qualified heat pumps.